Blockchain networks rely on consensus mechanisms to ensure security, validate transactions, and maintain decentralization. Among the most widely used methods, Proof of Work (PoW) and Proof of Stake (PoS) dominate the landscape. Each has distinct features, strengths, and weaknesses that influence their suitability for different blockchain projects.

This blog provides an in-depth exploration of PoW and PoS, explaining how they work, their advantages, challenges, and the impact they have on blockchain technology.

Introduction

What Are Consensus Mechanisms?

Consensus mechanisms are systems that enable decentralized blockchain networks to operate without a central authority. They ensure that all participants agree on the state of the blockchain, validate transactions, and prevent malicious activities like double-spending.

These protocols maintain the integrity and trustworthiness of blockchain systems, forming the foundation of cryptocurrencies.

The Role of PoW and PoS in Blockchain

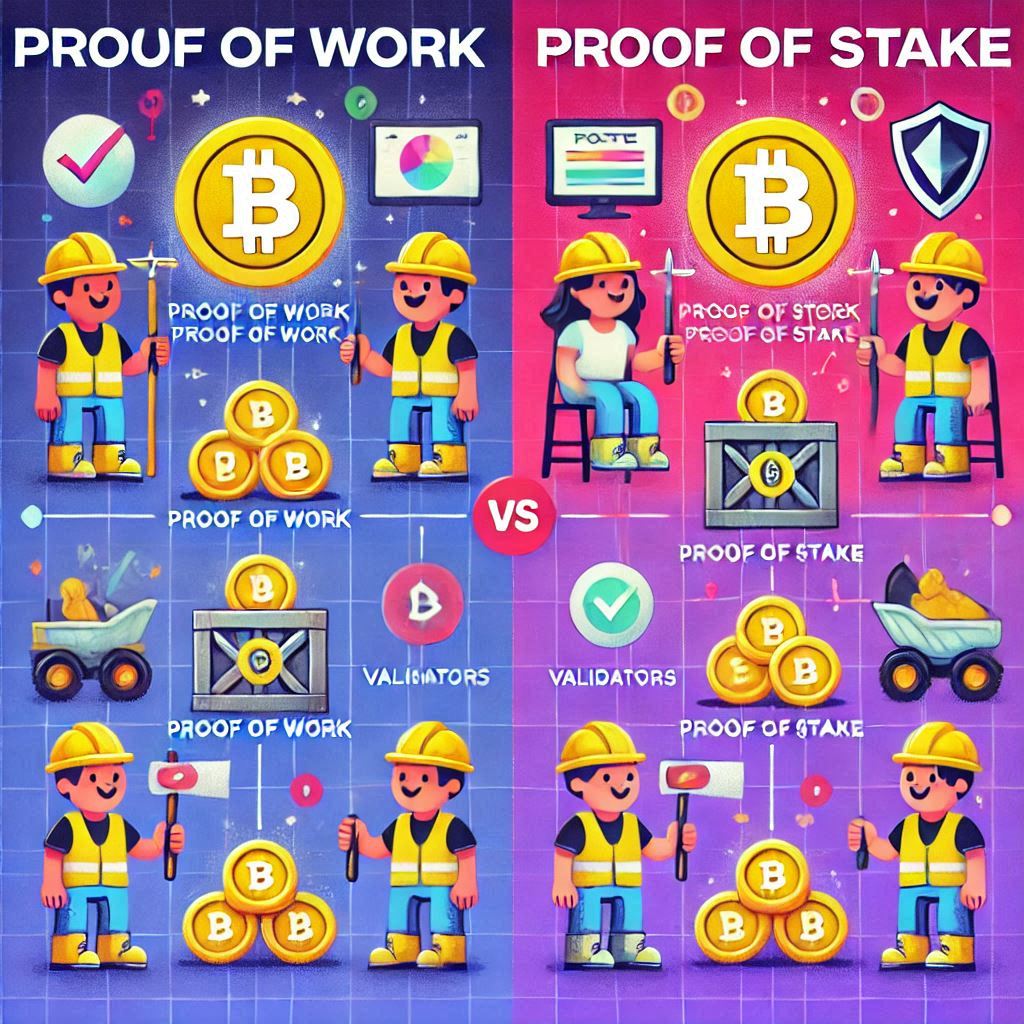

PoW and PoS are two major consensus mechanisms. PoW, first introduced with Bitcoin, relies on computational effort to secure the network. PoS, on the other hand, leverages financial stakes to achieve consensus and promote scalability. Together, they represent the evolution of blockchain technology.

What is Proof of Work (PoW)?

Definition and Overview

Proof of Work is the original consensus mechanism, first implemented in Bitcoin by Satoshi Nakamoto. It relies on miners who solve cryptographic puzzles to validate transactions and add new blocks to the blockchain. This process requires immense computational power, making the network secure against attacks.

How Does PoW Work?

- Transaction Validation: Miners collect pending transactions from the network and organize them into a candidate block.

- Puzzle Solving: Miners compete to solve a mathematical problem by finding a specific hash value. This requires repeated computation until the correct solution is discovered.

- Block Addition: The miner who solves the puzzle first broadcasts the solution to the network. Other nodes verify the solution, and if valid, the block is added to the blockchain.

- Reward Distribution: The winning miner receives a block reward in cryptocurrency and transaction fees for their efforts.

Examples of Cryptocurrencies Using PoW

- Bitcoin: The first and most prominent PoW cryptocurrency, prioritizing security and decentralization.

- Litecoin: A Bitcoin fork that uses PoW with a memory-intensive algorithm called Scrypt.

- Dogecoin: A popular PoW-based cryptocurrency known for its vibrant community.

Table: Key Features of PoW

| Feature | Description |

|---|---|

| Computational Power | Miners solve puzzles using powerful hardware. |

| Energy Usage | High energy consumption due to mining operations. |

| Security | Secures the network by requiring significant resources. |

| Block Rewards | Incentivizes miners with cryptocurrency rewards. |

What is Proof of Stake (PoS)?

Definition and Overview

Proof of Stake is a modern consensus mechanism designed to address the inefficiencies of PoW. Instead of miners, PoS uses validators who stake their cryptocurrency as collateral to secure the network. Validators are chosen to propose and verify blocks based on their staked amount and other criteria.

How Does PoS Work?

- Staking: Validators lock up a certain amount of cryptocurrency as collateral.

- Block Proposal: The protocol randomly selects a validator to propose a new block. The probability of selection increases with the amount of cryptocurrency staked.

- Validation: Other validators confirm the proposed block’s validity.

- Reward and Penalty: Honest validators earn rewards, while dishonest or inactive validators may lose a portion of their staked funds.

Examples of Cryptocurrencies Using PoS

- Ethereum 2.0: Transitioned from PoW to PoS to improve scalability and reduce energy consumption.

- Cardano: Uses a PoS protocol called Ouroboros, emphasizing sustainability and decentralization.

- Solana: Combines PoS with Proof of History (PoH) for high-speed transactions.

Table: Key Features of PoS

| Feature | Description |

|---|---|

| Energy Efficiency | Avoids energy-intensive mining processes. |

| Economic Security | Validators are incentivized to act honestly through staking. |

| Scalability | Supports higher transaction throughput compared to PoW. |

| Green Approach | Significantly reduces environmental impact. |

Key Differences Between PoW and PoS

| Aspect | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Energy Consumption | High due to computational mining. | Low as no mining is involved. |

| Hardware Requirements | Requires specialized hardware like ASICs. | Minimal hardware needed. |

| Transaction Speed | Slower due to mining complexity. | Faster with streamlined validation. |

| Security Model | Secured by computational power. | Secured by financial stake. |

| Decentralization Risks | Mining pools may centralize power. | Wealthy validators may dominate. |

| Environmental Impact | Significant due to energy use. | Minimal due to energy efficiency. |

| Reward Mechanism | Rewards based on computational effort. | Rewards depend on staked assets. |

Advantages of Proof of Work

- High Security: PoW’s reliance on computational power makes it extremely difficult for attackers to manipulate the blockchain.

- Proven Reliability: PoW has a long history of success, especially in Bitcoin, which has never been compromised.

- Decentralization: Anyone with sufficient resources can participate, supporting a decentralized network.

- Predictable Reward Structure: Mining rewards are based on measurable effort, ensuring fairness.

Advantages of Proof of Stake

- Energy Efficiency: PoS eliminates the energy-intensive mining process, making it environmentally friendly.

- Scalability: PoS systems handle more transactions per second, making them suitable for modern blockchain applications.

- Cost-Effectiveness: Validators don’t need expensive hardware, lowering the barrier to entry.

- Economic Security: Validators risk losing their stake, promoting honest behavior.

Challenges of PoW

| Challenge | Description |

|---|---|

| Environmental Impact | PoW mining consumes vast amounts of energy. |

| High Costs | Mining equipment is expensive and has a short lifespan. |

| Centralization Risks | Mining pools can dominate, reducing decentralization. |

| Slow Transactions | Limited scalability due to the mining process. |

Challenges of PoS

| Challenge | Description |

|---|---|

| Wealth Inequality | Wealthy validators can dominate the network. |

| Slashing Risks | Validators risk losing their staked cryptocurrency. |

| Unproven Durability | PoS systems have less long-term testing compared to PoW. |

| Entry Barriers | Smaller holders may find it harder to participate. |

The Transition from PoW to PoS: Ethereum’s Journey

Ethereum’s shift from PoW to PoS, known as “The Merge,” illustrates the potential benefits of PoS:

| Aspect | Ethereum (PoW) | Ethereum 2.0 (PoS) |

|---|---|---|

| Energy Use | Comparable to a small nation. | Reduced by over 99%. |

| Transaction Speed | Limited to 15 TPS. | Improved with shard chains. |

| Environmental Impact | High carbon footprint. | Minimal carbon footprint. |

Conclusion

Proof of Work and Proof of Stake are foundational to blockchain technology, offering unique approaches to achieving consensus. While PoW ensures unparalleled security, PoS addresses energy concerns and scalability. As blockchain technology evolves, hybrid systems or new innovations may emerge, combining the best aspects of both mechanisms to shape the decentralized future.

For blockchain users, developers, and enthusiasts, understanding these mechanisms is key to navigating and contributing to this transformative technology.

Discover more from lounge coder

Subscribe to get the latest posts sent to your email.